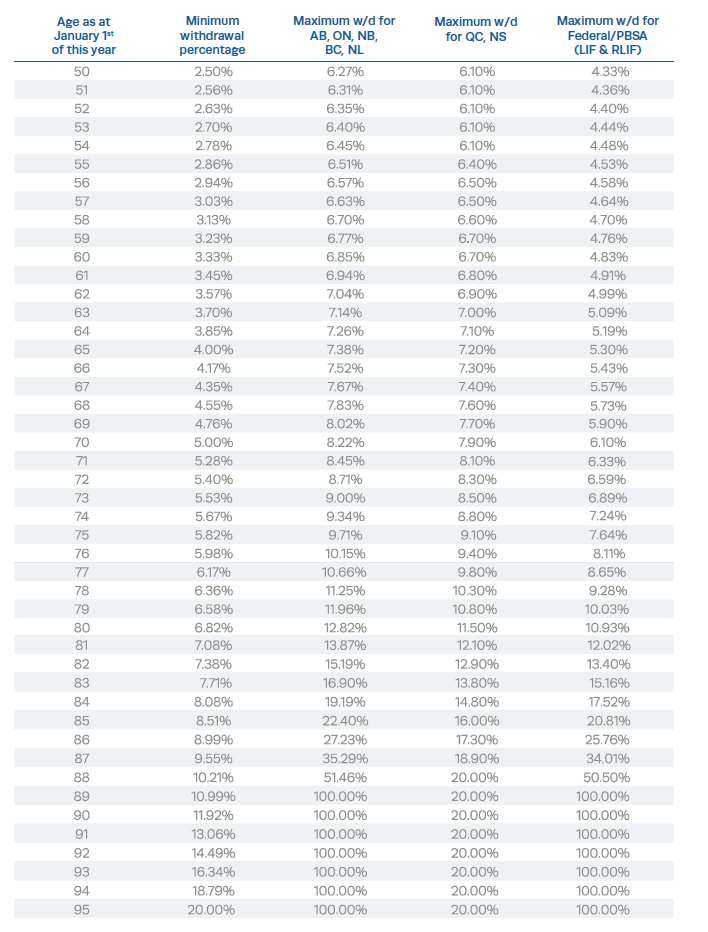

Below is a table showing the minimum and maximum withdrawal percentages for LIF and RLIF accounts in 2022 by province. Depending on your age or your spouse’s age (whichever you select), you must withdraw an amount between the minimum and maximum amounts as outlined by the percentages below.

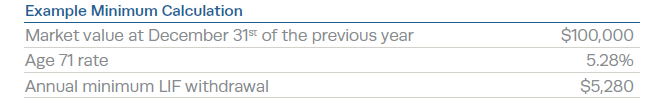

An example calculation is included below; however, if you still need assistance with determining your withdrawal options, we recommend that you contact an investment professional.

NOTE:

Quebec, Alberta, New Brunswick, and British Columbia pension legislation permits LIF clients who begin a LIF in the middle of a calendar year with funds transferred from a LIRA or pension plan to take the full maximum payment for the year. First year payments under the other jurisdictions must be prorated based on the number of months the LIF was in force.

ON, BC, AB, NL maximum calculations are based on the greater of a) the result using the factor and b) the previous year’s investment returns.

Source: Service Canada. Figures updated December 2021. Visit servicecanada.gc.ca for updated figures.